Bitcoin has outdone itself, hitting $42,000 in January 2021, and $48,200 on February 11th, 2021. By the time you are reading this, BTC might have an even higher all-time high. As such Bitcoin continues to attract investors, many of which are new and have just entered the crypto industry seeking their fortune. If you count yourself among them, and you need help finding the best way to buy cryptocurrency in 2021 — you have found the right place. We will explain everything about where to buy BTC, how to do it, as well as some additional info, such as what to look out for and what are the benefits of using Bitcoin.

Where to Buy Bitcoin?

Bitcoin can be purchased on a number of crypto exchanges, or through cryptocurrency brokerages. Crypto brokers might be a safer option, as they are regulated and licensed by the regulatory authorities. “If they cannot provide a license that they are allowed to operate, they are most likely scams or shady in some other way, and are best to stay away” according to Adam Grunwerg, CEO of Crypto PR.

Of course, while brokers are regulated, they are also more expensive, as you need to pay for their services, as well.

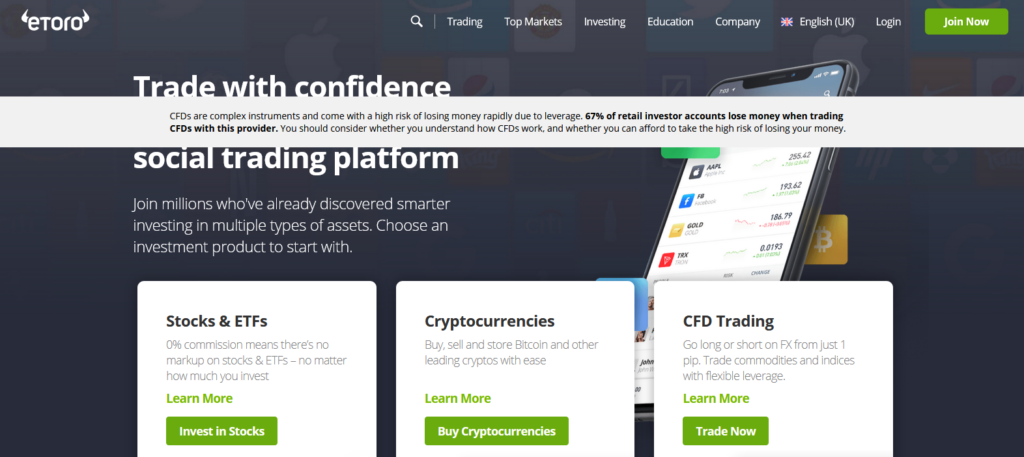

We can recommend eToro — one of the best social trading and investing platforms in the world — as a great option for new and experienced crypto traders.

Buying Bitcoin on eToro in 5 quick steps

If you wish to buy BTC on eToro, there are only five short steps that you need to follow, and those are:

- Register on eToro

- Verify your account

- Make a deposit

- Find Bitcoin and enter the amount you wish to buy

- Buy BTC, and then keep it safe until you decide to do something with it

Now, let’s see a more detailed explanation of these steps.

How to Buy Bitcoin on eToro?

Starting off on eToro is extremely simple and very quick. In fact, all you need to do in order to start trading is go through 5 very simple steps. We will guide you through them now, so you can do it yourself, along the way.

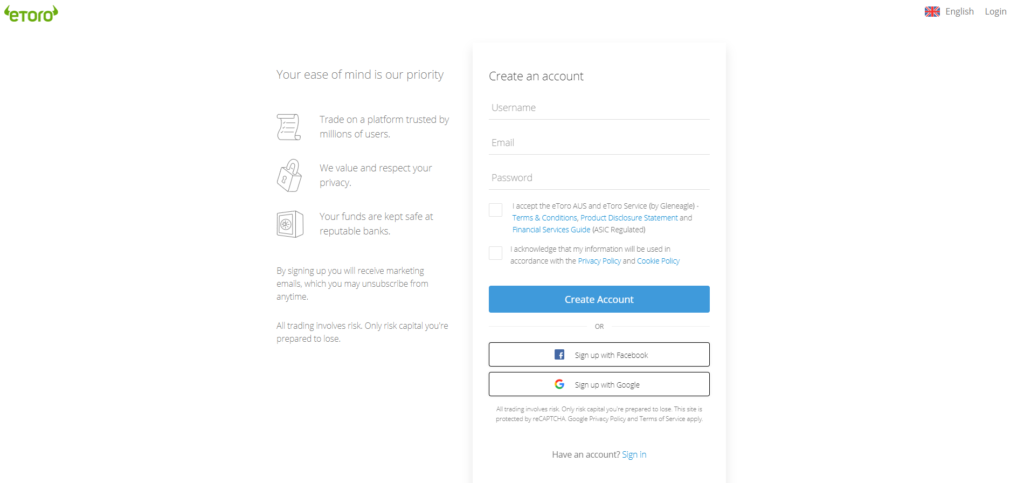

1) Register on eToro

The first step will be to open an account on eToro. This is a very simple thing to do, and all it comes down to is filling up a few fields that request usual information, such as your username, email, and password. You can even sign up with Facebook or Google if you don’t feel like creating a separate account.

2) Verify Your Account

The next step is account verification. In order to buy, sell, and trade on eToro, you need to have your account verified. This is not a complicated process, and it only requires you to enter some additional data, such as your first name, last name, address, social security number/passport number, and alike.

But, after providing this and similar info, eToro will quickly review your information and confirm your identity. After that, you will be free to proceed to the next step, which is:

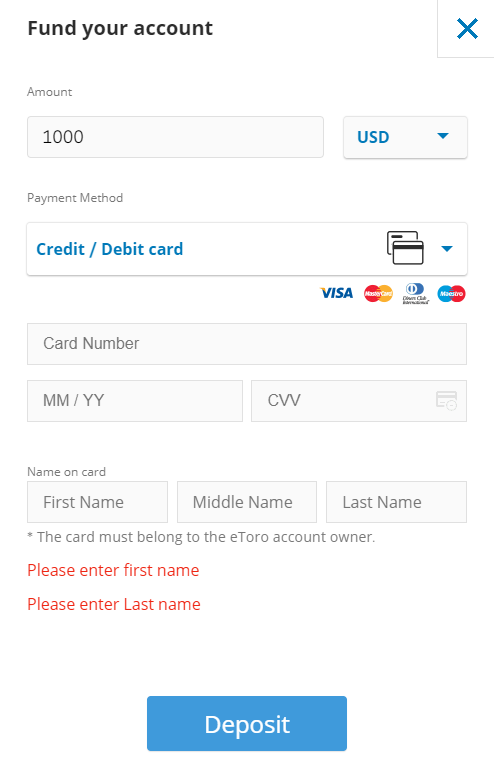

3) Make a Deposit

With your account created and your identity verified, you are now ready to make a deposit. You can do so by clicking on the big blue button in the bottom-left corner of your Dashboard that says “Deposit Funds.”

After doing so, you will be taken to a new window that will allow you to link your card and select the amount of money that you wish to deposit. Just fill out the details, and you will be able to bring your money to the platform in no time.

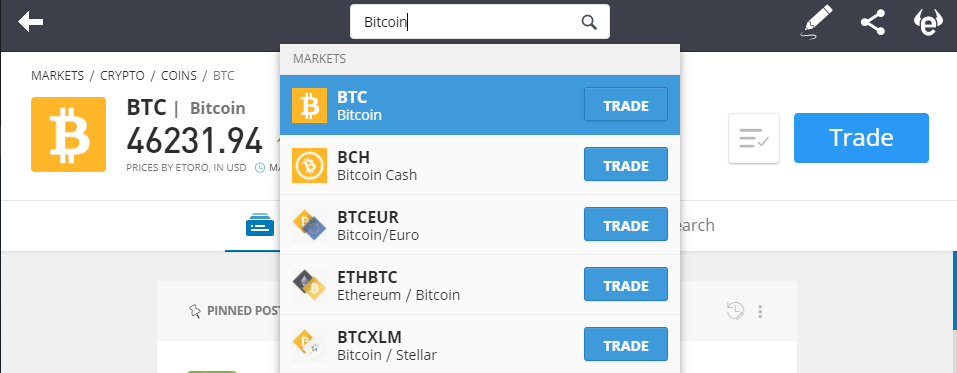

4) Find Bitcoin

We are now very close to actually buying BTC, and this next step will have you find it on the platform. This is as simple as it can get, and all you need to do is type in “Bitcoin” in the search field on the top of your screen. After that, you can add it to your Watchlist in order to have it close at hand, or you can just search for it as described every time.

5) Buy Bitcoin

Next to the coin’s name and price, you will see a big blue button that says “Trade.” Click on it, and you will be presented with another new screen that will let you decide on how many coins you wish to buy, it will let you set a stop-loss or take-profit order, and it will even let you use leverage.

Once you set everything up to your liking, simply click the ‘Open Trade’ button, and you will officially become the owner of whatever amount of BTC you opted to buy. At this point, you can keep your coins in your wallet within the exchange, which is not actually recommended. It would be safer to withdraw them to your private wallet, where you will be their sole manager.

Alternatively, you can spend your BTC online, exchange it for some other cryptocurrency, or keep it briefly until its price grows, and then sell it at a higher price, to make profits from the difference.

That’s about all there is to it, and now, let us present you with the benefits of using eToro, as well as some other platforms that you might want to consider if eToro is not an option for some reason.

The Best Places to Buy Bitcoin in 2021

1) eToro

As we have seen, using eToro is extremely simple, and there are only 5 steps between you and owning BTC, one of which is a simple use of a search function. It is heavily regulated, meaning that users will always be safe while using it. It has licenses of as many as three different regulators — CySEC, ASIC, and FCA.

The platform has millions of investors, and it has been around for years — all of which further improves its legitimacy and credibility. It is also great in terms of fees, as it allows users to trade without commission. Instead, all it charges is a 0.5% fee when you make a deposit.

You also don’t have to risk a lot of money if you are a beginner at trading, as eToro has a minimum amount of only $25. This is much lower than some other platforms, which often require you to enter a trade with $100, $200, or more.

Apart from Bitcoin, it also offers access to 15 other coins, including Ethereum (ETH), Bitcoin Cash (BCH), XRP (XRP), Dash (DASH), Litecoin (LTC), Ethereum Classic (ETC), Cardano (ADA), IOTA (MIOTA), Stellar (XLM), EOS (EOS), NEO (NEO), TRON (TRX), Zcash (ZEC), Binance Coin (BNB), and Tezos (XTZ).

Of course, eToro offers access to more than just cryptocurrencies. It also lists over 1,700 stocks, and over 150 ETFs, CFDs, and even crypto CFDs as of January of this year.

eToro Pros:

- Offers a number of major cryptocurrencies

- Bitcoin purchases are commission-free

- Allows users to invest with small amounts (minimum $25)

- Supports various transaction methods, including e-wallets, cards, and bank transfers

- Fully regulated by three different regulators

- A lot of available assets aside from cryptos

- Millions of users

- User-friendly and perfect for newcomers to the crypto industry, as well

eToro Cons:

- It has a deposit fee of 0.5% and a withdrawal fee of $5

- Operates only in USD

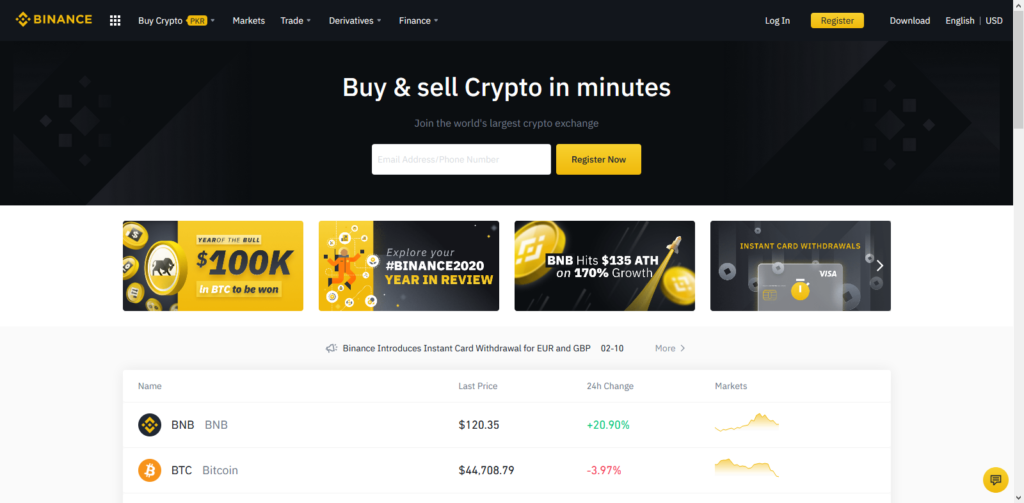

2. Binance

Next up, we have Binance. Binance is well-known for being the world’s largest crypto exchange by trading volume. The exchange has been active since 2017, and in the last several years, it created a massive ecosystem that offers:

- Two blockchains

- A centralized exchange

- A decentralized exchange

- Multiple fiat-to-crypto subsidiaries on different continents

- Its own native cryptocurrency

- Its own stablecoin

- Its own wallet

- A crypto debit card

- Binance Launchpad

- An upcoming Binance Pay service, and more.

Binance’s focus is still mostly on providing trading services, and it is known for its massive crypto offering. However, you can also access other, more complex financial products, including Bitcoin options and futures.

Binance also works as a brokerage service, it did a lot to increase security after a hack that took place in mid-2019. In terms of fees, it is very competitive, offering a very low 0.1% commission per trade. Users should note, however, that there are also 2% transaction fees.

Binance Pros:

- The biggest and best-known crypto exchange

- Low trading fees

- Good reputation

- One of the best examples when it comes to security

- Hundreds of crypto pairs

- A massive ecosystem bursting with various services

- Great for advanced traders

Binance Cons:

- 2% transaction fee on deposits

- Not that beginner-friendly

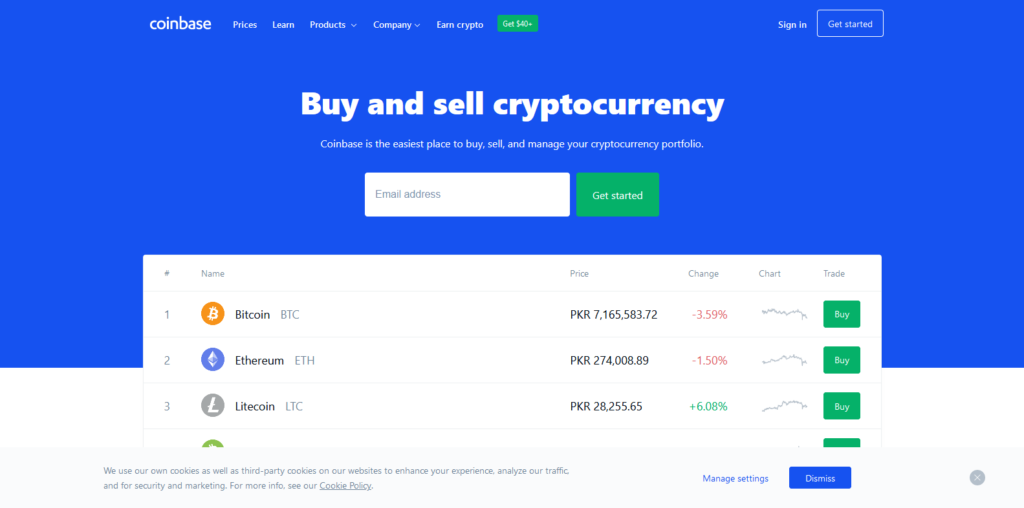

3. Coinbase

Coinbase is another excellent and well-known exchange that is considered trustworthy — not only by traders and investors, but also by regulators. Coinbase is the biggest crypto exchange in the US, and considering its location — it had to comply with rather strict rules, especially when it comes to coins that it has on offer.

The exchange has a strong and ever-growing ecosystem, and while it doesn’t offer a lot of coins on its base exchange, it does support Bitcoin, which is what we are interested in today.

If you are looking for a reputable exchange, this is likely your best option. Coinbase has been around since 2012, and in the last eight years, it managed to attract over 35 million users. It services over 100 countries, it is fully regulated, and most importantly — it is beginner-friendly, which is great for pushing adoption and attracting first-time crypto users.

Coinbase also allows users to start with fairly small amounts, although the minimum deposit depends on the payment method. In terms of fees, it is a bit more expensive than other entries on this list. Those who use debit cards for payments will have to pay 3.99% commission, while crypto trading itself will cost you 1.49%. But, while expensive, it is also extremely safe.

Coinbase was never hacked, and it wants things to stay that way. This is why only 2% of all the funds it holds are kept in hot wallets, to be immediately available. Everything else is in cold storages, safe from any hacker, scammer, or other type of harm.

Coinbase Pros:

- Very user-friendly

- Very safe

- Allows users to withdraw coins to a private wallet

- Users can deposit funds via card or bank

- Regulated

- Very reputable

Coinbase Cons:

- Very expensive deposits and transactions

Why Should You Consider Buying Bitcoin?

So far, we have told you where you can buy Bitcoin and how you can do it, but not why you should consider doing it, in the first place.

To explain that, let’s first talk about what is Bitcoin.

Bitcoin is a speculative asset class known as a cryptocurrency, digital currency, digital coin, or simply — crypto. It was invented over 12 years ago now, after the economic crisis that was caused by the banks’ greed. One man, or a group, known only as Satoshi Nakamoto, created it and launched it on January 3rd, 2009.

At the time, Bitcoin did not have any value, but it did offer a new world of decentralized finance, where the community would take care of transactions and payments. This decentralization brought a way of handling money without depending on the banks, and without them having all the power.

As a result, the transactions were cheaper and faster, transparent and completely trustless. Without the need to travel through countless barriers, Bitcoin transactions can be completed extremely quickly, even if you are sending money to the other side of the world.

Bitcoin started the cryptocurrency trend, which eventually exploded. This trend also led to the creation of development platforms, the first of which was Ethereum, and which revealed the true possibilities of blockchain — cryptocurrency’s underlying technology. That, in turn, led to the creation of smart contracts, decentralized applications (dApps), and the entire decentralized finance (DeFi) sector of the crypto industry, which has attracted massive attention and interest in 2020, and which continues to do so in 2021.

With that out of the way, let’s get to the topic at hand:

Why Buy BTC?

The reasons why you should buy BTC — as well as why you should choose this cryptocurrency instead of others — are many, and a lot of people are realizing this. Bitcoin adoption is skyrocketing faster than ever before.

The number of merchants that accept it is on the rise, institutional investors are hoarding it through intermediaries such as Grayscale or Microstrategy, and the coin’s surging price constantly attracts new users.

This can be confirmed by the reports of growing number of active wallet addresses containing Bitcoin, its volume, and, of course, its price itself. But, if you want even more solid reasons why to choose BTC, here are a few that might convince you.

1) Bitcoin Grows Faster than Any Other Asset

The road that the coin’s price has traveled is truly remarkable. Only 12 years ago, Bitcoin’s price was only a fraction of a cent. Eight years later, in 2017, the coin hit the $20,000 all-time high, which was its record for almost exactly three years.

In late 2020, Bitcoin surpassed this milestone, and before the year ended, it nearly reached $30,000. By January 8th, 2021, Bitcoin hit $42,000 per coin. Only one month later, it skyrocketed again, hitting $48,200 by February 9th, 2021. Predictions for the coin’s future vary greatly, and some expect it to hit $75,000, or $100,000, or even $500,000. The latter is unlikely this time around, although still not impossible. After all, with institutional investors’ involvement, nothing is certain, and the coin could easily skyrocket given the fact that there is a major lack in supply, while the demand continues to surge.

2) Limited Supply

While we are on the topic of limited supply and growing demand, Bitcoin is not endless. It can only ever have 21 million coins in existence, as that is its total supply. The coin continues to approach this number with every new block that gets mined. However, with more and more people using BTC, and its supply being relatively small compared to the number of people in the world, it is clear that BTC price can only go up to accommodate the demand.

In the past, it was believed that Bitcoin could someday become the currency of the world. However, given its scalability issues and slow block processing, it is far more likely that some other cryptocurrency will take on that role, and that Bitcoin will replace gold as a store of value.

3) If You Own Bitcoin, You are a True Owner of Your Money

Another reason why you should consider investing your money into BTC is the fact that Bitcoin cannot be controlled by the banks. Think about it — if your bank wanted to do it, it could freeze your accounts, and, in extent, any money that you have within. You would be left with nothing, unless you are one of the few people who insist on keeping all of their money in cash.

On the other hand, if you have Bitcoin in your personal wallet, nobody else can ever have access to it but you. Of course, wallets can be broken into, but set up a strong enough password, and you will be safe. For extra security, you should consider always using a hardware wallet to store the majority of your funds. That way, your crypto will not even be on the internet for others to try and steal.

4) You Don’t have to Buy the Entire Bitcoin

Earlier, when we spoke about Bitcoin’s price hitting $48,000 per coin, you may have though “How can I afford to buy Bitcoin at that price?” The good news is that you don’t have to. Bitcoin can be fractionated. Just like a dollar can be broken into cents, so can Bitcoin be broken into smaller units called satoshis, named after Bitcoin’s founder, Satoshi Nakamoto.

One Bitcoin is worth 100,000,000 satoshis, which means that one satoshi is $0.00047 at the time of writing, when Bitcoin’s price sits at $46,740.64. In other words, if you were to buy $1 worth of Bitcoin, you would have 2,145 satoshis at your disposal.

As you can see, you can buy as much BTC as you can afford to set aside for such a purpose at any given time.

5) You can Buy Bitcoin on PayPal

Another piece of evidence that the crypto industry is here to stay is the fact that even PayPal gave up on trying to ignore digital coins. PayPal, which was well-known for refusing to deal with exchanges and trading platforms even when it comes to simply allowing users to transfer money to and from them, has announced adding cryptocurrencies to its own website.

The announcement came in the second half of October 2020, only for cryptos to be added for US users a few weeks later. PayPal promised that other countries will get the same features in early 2021. So, if you are from the US, you can already go to your PayPal account, deposit some money, and buy Bitcoin in seconds.

If you are from some other country, PayPal will likely allow you to do the same in a matter or months, or maybe even weeks. When it happens, it will likely strengthen the current Bitcoin rally even further.

Are There Risks to Buying and Owning Bitcoin?

In order to be fully transparent, we will also mention the biggest risks and benefits of owning BTC. There are a few things that should be pointed out, although likely nothing that you do not already know.

The biggest risk of owning Bitcoin is volatility. This is a well-known fact, and something that traders and investors around the world are taking advantage of in order to earn. Simply put, Bitcoin’s price is unstable, and it goes up and down all the time. Even when it is seemingly standing still, it is likely moving up and down by tens, or even hundreds of dollars. In times of true volatility, the changes can even include thousands of dollars, especially these days.

But, as mentioned, you can use this to your advantage, buy when it is low, and sell when the price is high. As a result, you can make a profit off of the difference.

The next thing that can be problematic is the fact that Bitcoin — and indeed, the entire crypto industry — is not regulated. Some countries are working on regulating digital coins, but many are not, or were unsuccessful in their attempts. This is also not surprising, given that the crypto industry is a young industry, and that is still evolving.

This regulatory uncertainty is also what is keeping institutional investors at bay. We have mentioned that institutions have shown a lot more involvement now than ever before. However, the fact is that the majority of them are still hesitant to do so. When the regulatory situation is settled, and institutions truly come to the crypto industry — that is when the price of Bitcoin can be expected to go to $500,000 per coin, or possibly even more. Of course, all such predictions are merely speculation, and should not be taken as anything more than that.

Lastly, there is a matter of theft, or loss. Bitcoin is safe because it is difficult to access. However, that is also a threat to investors who own it. If you forget your password, you can lose access to your coins forever. This has already happened to a lot of people. Some have even placed their coins in cold storage, only to mistakenly throw it away. In such cases, people were known to search through entire junk yards in order to find their hardware wallets — usually without success.

And, let’s not forget that hardware wallets can be stolen in break-ins, just as easily as online wallets can be hacked if the wallet has a flaw, or if your password is too weak and easy to guess. This is why you must make it a priority to secure your coins as best as you can, while still having them comfortably close and convenient to use.

Final Thoughts

As you can see, Bitcoin is here to stay — there is little question about that. It is a strong, decentralized asset, and the face of the entire cryptocurrency industry. So far, it has shown impressive price growth, it is easy to buy and manage, and you can easily keep it safe if you know the basics of securing online accounts, which will be very helpful with securing your crypto wallet.

Best of all, Bitcoin is easy to obtain from a number of sources, specifically exchanges and brokers mentioned above. So, if you are wondering whether or not to buy it, we can confirm that there are quite a few benefits to acquiring it, as explained above. In the end, the decision regarding whether or not to go for it is on you.

FAQs

What can I do with Bitcoin?

You can spend Bitcoin by using it to pay for goods and services in online stores that accept it. Alternatively, you can sell it when its price grows a bit, and make a profit. You can also keep it for a longer time, and wait for the price to surge a lot before selling it.

Is it possible to buy Bitcoin anonymously?

It is difficult, but still possible. In most cases, buying BTC requires going to centralized exchanges where you need to verify your account, and every transaction between the exchange and your wallet will be recorded, and it will reveal your identity. You can go around this by using Bitcoin mixers or P2P platforms where you pay directly to another user and get the coins without revealing who you are.

Which currencies can I use to buy BTC?

Most platforms support all major fiat currencies, such as the USD, GBP, EUR, JPY, AUD, CAD, and alike.

What is the minimum BTC investment?

Most of the time, the minimum investment depends on the platform you are using. Some platforms, like eToro, allow you to only spend $25. Some will require a bit more, while others might want you to use significantly more money.

In what ways can I acquire Bitcoin??

Bitcoin can be bought on exchanges, including centralized and decentralized platforms. You can receive it as a gift, or as payment for some sort of work, provided that you find an employer who would pay for your services with it. You can also earn Bitcoin through mining, Bitcoin faucets, or by exchanging another cryptocurrency for it.

Questions & Answers (0)